Self-funded insurance is becoming a popular choice for employers looking to regain some control over their employee benefits. They are an excellent alternative to traditional fully insured health plans and offer many advantages, including lower administrative costs, greater flexibility in plan design and greater financial accountability.

What is an Self-Insured Healthcare Plan?

A self insured health program is an arrangement whereby the employer pays claims to healthcare providers using both its own funds as well as enrollee contributions. These funds will be deposited into a special trust account to cover claims. The employer typically works with a knowledgeable broker or third-party administrator (TPA) to manage the process and help ensure the plan is properly designed for its employees and the business's budget.

What Is a Self Funded Insurance Plan?

A self-funded insurance plan is a medical, dental and vision benefit program that uses an employer's own money to pay for health care services. This is an ideal option for smaller business owners, who can manage their expenses. The plan can also cover the dependents of an employee who don't have access to other insurance options such as Medicare and Medicaid.

What is an Self-Funded Plan?

A health insurance plan which combines the employee-sponsored component of self-insurance with a contract for group coverage with an external carrier. Often the employer contracts with an outside TPA to handle the administration of the self-insured components, such as enrollment, claims processing and network drafting.

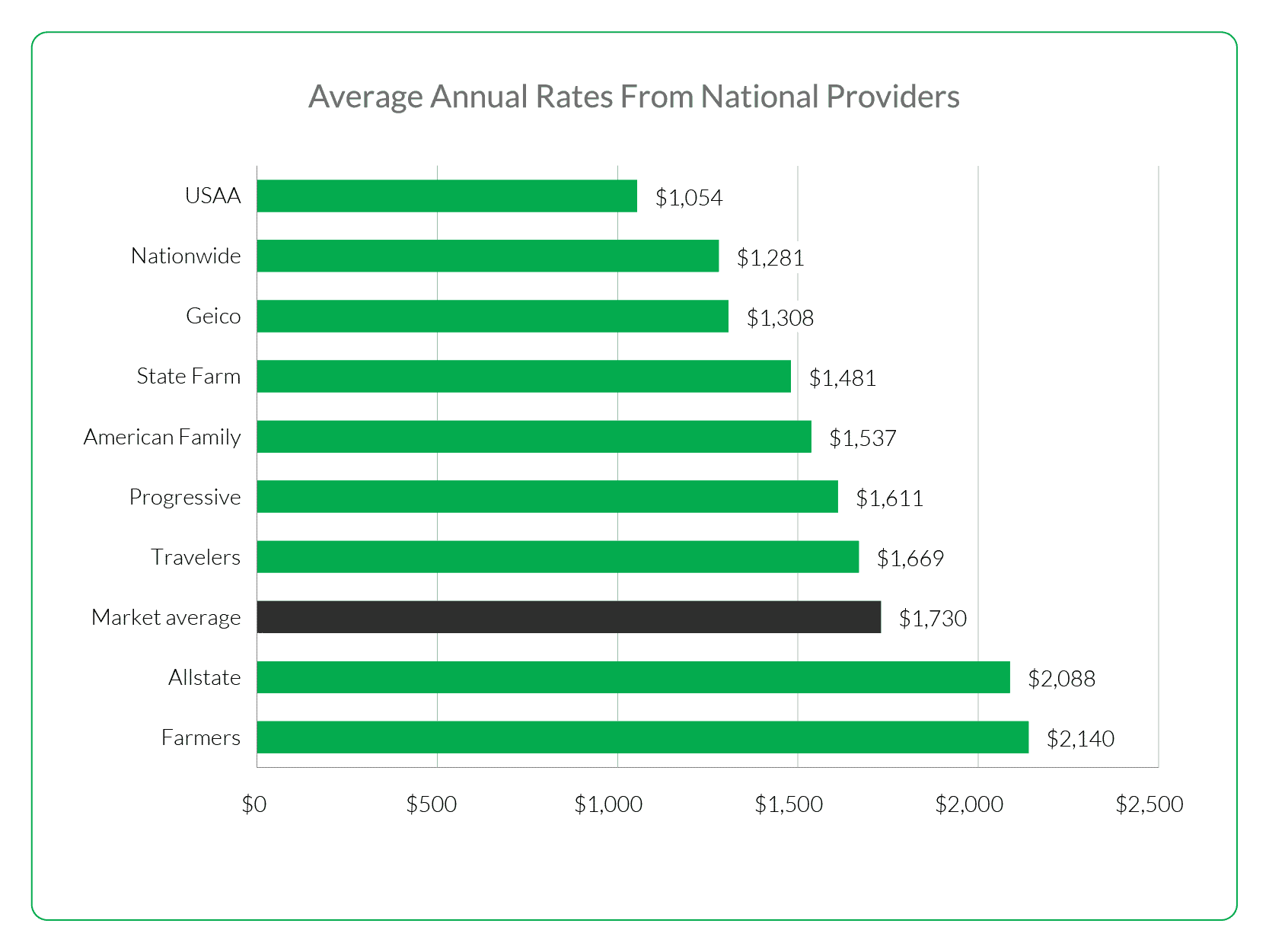

The administrative costs of an employer are very similar to the cost of a plan that is fully insured. The only difference between self-funded and fully insured claims is that they are billed each month, rather than annually. These monthly costs consist of administrative fees and stop-loss insurance premiums as well as the variable cost for healthcare, otherwise known by the term claims expense.

Shock claims are a real risk in self-funding

As their name implies, these claims can be so catastrophic that they are enough to ruin a self funded plan. These large claims can easily exceed half a million dollars for a single individual's healthcare treatment over the course of several years. Shock claims may also negatively impact the employer's finances, since they can drain company reserves and result in negative cash flow.

Understanding Self-Funded Health Insurance

Self-funded health plans are not suitable for everyone. Employers are concerned about the possibility of expensive claims. It is important to weigh up both the pros and cons when choosing a plan.

A self-funded health plan enables the employer to choose the most effective benefit package for its workforce, reducing costs and improving overall employee wellness. This allows employers to become more involved in population management programs, like weight loss and smoking cessation. It is a great option for small and mid-sized businesses that want to control their employee's health costs while encouraging healthy behaviors and increasing the quality of care for their workers.