Long-term insurance is ideal if you plan to travel abroad more than one month. This includes backpackers and digital Nomads. This type of policy covers you for up to 18 months, and many companies offer add-ons that can cover adventurous activities or watersports, as well as cruises.

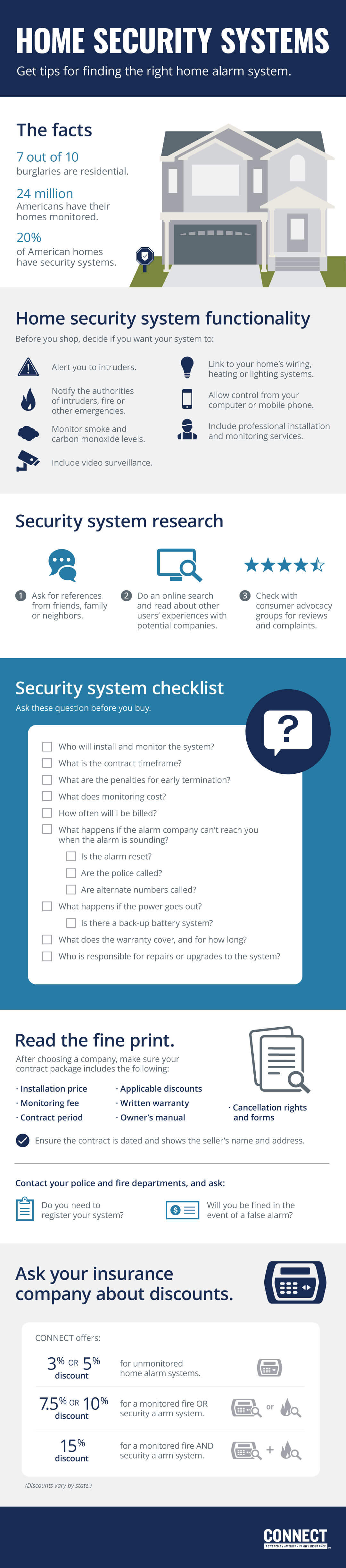

It's vital to carefully read the fine print when purchasing long-term travel coverage. This will help you understand what is and isn't covered. You may not get coverage if you already have a medical condition. So, make sure you disclose this when you apply.

You can also opt for cancel-for-any-reason (CFAR) coverage, which will reimburse you a percentage of your trip costs if you have to cancel your trip due to an approved reason such as an illness or death in the family. You can purchase this option as a stand alone product or as part of a comprehensive policy.

If you suffer from chronic illness or have been injured, it is best to get a policy which offers evacuation and emergency medical coverage. If you are injured or ill while on vacation, this will cover the cost of transportation to a hospital.

Some companies offer reimbursement for changes in flight plans that are caused by a schedule delay, such as missing a connection flight or having to wait. This coverage is ideal for long-term travellers who constantly change their plans.

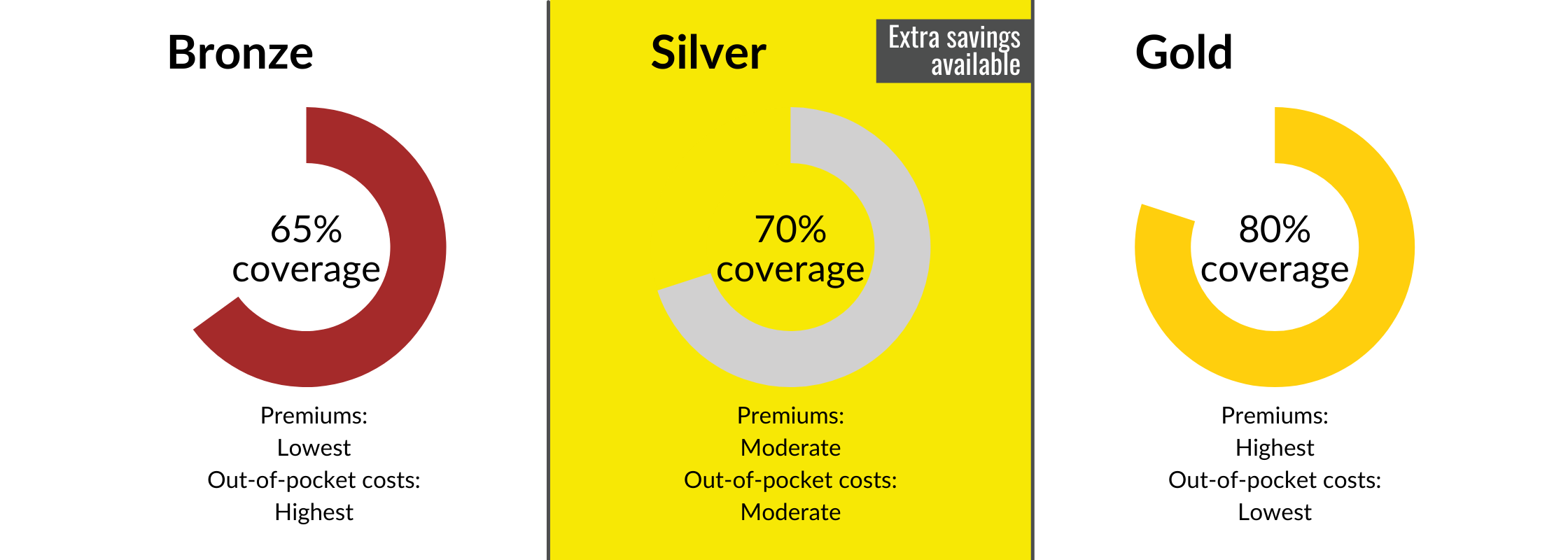

You should buy a policy that has a low deductible so you won't be responsible for any out-of pocket expenses if an emergency occurs. Most policies will have a higher deductible. Shop around to find the lowest price.

It's crucial to select a reputable provider when purchasing travel health insurance. They should offer a high-level of customer service. It will help you feel confident about your decision, and you'll be able get the treatment you need in an emergency.

Allianz is the leader in the industry and has been for over 55 year. This is due to the financial strength that Allianz SE, its parent company, possesses. It is a trusted name for travel health insurance, providing global coverage each year to millions of individuals.

A travel medical policy is purchased primarily to avoid paying expensive out-of pocket medical expenses in the case of an injury or illness while on vacation, as well as to protect yourself from becoming sick or hurt abroad. Many policies include a 24-hour medical hotline which will help you contact a doctor in case you are ill.

The policy may include additional benefits such as emergency treatment and coverage for return of mortal remains. Talk to a specialist broker about your travel health needs if you are unsure of the benefits you will need. The broker can help guide you and recommend the right policy.