The average Michigan home insurance price is $2,716 per year. Detroit homeowners are paying $2,716 an annual average for home insuring, while residents of Ann Arbor, Westfield, and Westfield are paying approximately $1,321 to $477 each. You can tailor your coverage to fit your needs and budget.

Detroit home insurance cost $2,716 annually

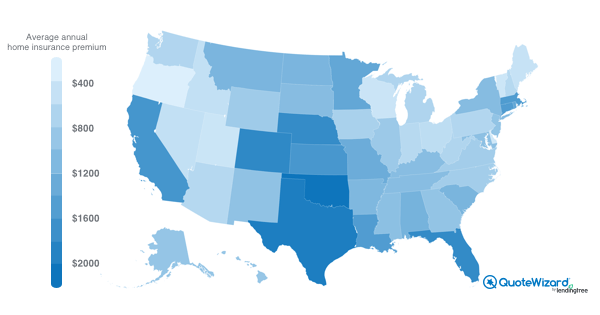

Detroit's average cost for home insurance is $2716 per calendar year. This compares to $1,200 nationally. This cost is comparable to the monthly rent in a studio apartment. The location is not the only factor that drives the higher cost. Credit scores and coverage are also factors. You can use a home insurance calculator to compare the prices of different Michigan home insurance policies. In addition, you should make sure that your insurer is financially sound because this will be important should you need to file a claim.

Ann Arbor home insurance starts at $1,321 annually

Ann Arbor's homeowners insurance average cost is $1,321. Detroit has the highest homeowners insurance cost at $2,085. Ann Arbor insurance can be cheaper. You can choose to have a higher deductible, which will help you save money. Ann Arbor homeowners who have a $2,500 minimum deductible will spend $230 less each year on insurance than those who have a $1,500 maximum deductible.

Westfield Home Insurance costs $1,477 annually

You can find quotes from different Westfield insurance companies to help you compare and save money. You can also speak to representatives from different insurance companies. If you have concerns about the cost of replacement cost coverage for your dwelling, you may be able to ask an agent from Westfield for a quotation.

Farmers offers customizable coverages

Farmers offers customizable coverages for home insurance in the state of Michigan. The website provides information about the policies available, as well discounts and endorsements. There are multiline, declining and green deductibles, affinity and green certification, rent to-own, good payer discounts, and timely payments. Farmers also offers insurance to protect against identity theft, flooding, earthquakes, and floods.

USAA is Michigan's cheapest insurance company

If you are a military family, USAA is a great place to get car insurance at the cheapest rate in Michigan. Customers can enjoy many discounts from the company such as loyalty, low miles, new car discounts, driver's education discounts, and discounts for defensive and safe driving courses. The company also offers discounts for storing a vehicle in a secure location. Michigan car insurance prices can vary greatly so it's worth comparing quotes to get the best deal.

State Farm Michigan is the most affordable insurer

While finding cheaper auto insurance premiums is easy, the consequences are even greater if you are involved in an accident or have a policy lapse. Michigan has liberal, no-fault laws that make it cheaper to insure your car. Using the phone book to find an independent agent is one option, but you may be better off just choosing a company with a good track record.

Allstate is the most affordable insurer in Michigan for $2 million of dwelling coverage

Allstate is the lowest-priced insurer in Michigan for a $2,000,000 dwelling coverage. This is based on MoneyGeek's analysis of six quotes from the top six insurance companies. The company provides quotes from many ZIP codes in the state. The company calculates its quotes based on an average home, which includes $250,000 for dwelling coverage, $100,000 for liability coverage, as well $100,000 in personal property coverage.