Insurance companies in Virginia offer a variety of policies to meet the state's insurance requirements. You can choose from a variety of policies to meet the state's insurance requirements. This is the cheapest type of insurance available, but it comes at the cost of limited coverage.

Virginia is the least expensive state in terms of liability insurance, with a cost of $408 annually. The national average is $643. However, if you want to cover your own vehicle, full coverage is recommended for the best protection.

In the event of an incident, a full-coverage insurance policy will also protect you against any other financial implications, including damage to your automobile, vandalism and theft. This type of insurance can be significantly reduced by choosing a high-deductible policy.

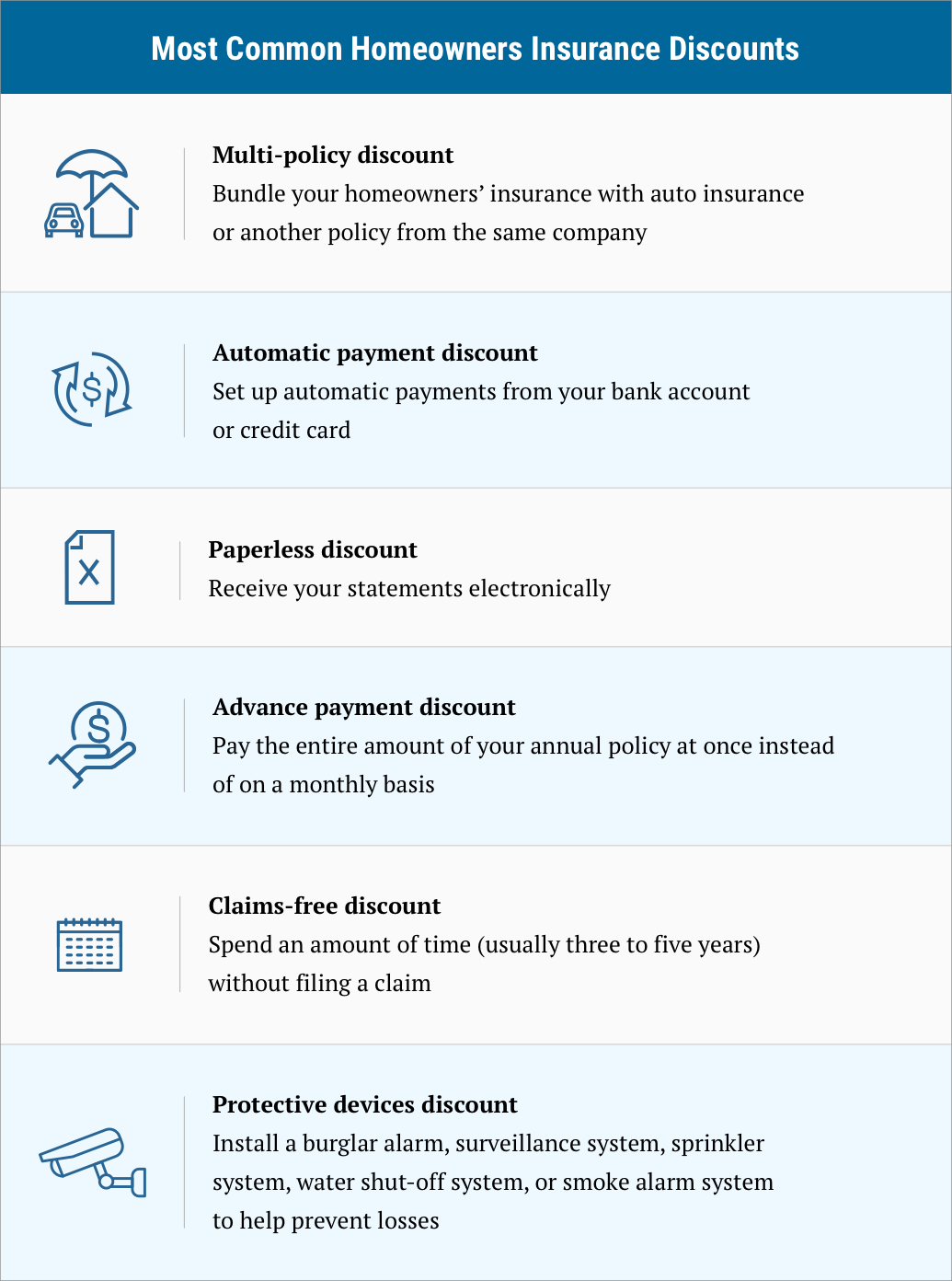

Discounts, Special Offers and Programs

You can save on your car insurance by taking advantage of discounts offered by most insurers in the United States. Examples include discounts for good drivers, accidents-free driving and multiple-policy policies. Some companies offer discounts to students, seniors or military members.

Discounts can be a great way to reduce your monthly costs if you're new. New drivers are usually offered a cheaper rate during their first year as compared to existing customers. Student discounts can reduce rates up to 20% for young drivers.

Compare multiple quotes from insurance companies Virginia to find out which one is the best for you. Each insurer has its own rating system and weighs factors like your driving record, location and age differently.

State Farm Geico Progressive and other companies offer the best auto insurance in Virginia to drivers with a criminal record. These three insurance companies offer competitive rates and great customer service.

These companies are known for providing affordable insurance policies for drivers with a bad record. They also provide multiple coverage options including collision and comprehensive. The companies also offer discounts for defensive driving and safety features.

Car insurance companies in Virginia are required to offer at least two types of discounts. The most common discounts include those for seniors, good drivers and military members. These discounts can help you save money on your premiums and reduce your overall risk of making a claim.

Online insurance quotes give you a good idea of what different companies offer. You only need to enter your ZIP Code and submit your details. In a few minutes, you'll be presented with an overview of the best deals in your area.

Finding cheap car insurance is much easier than one might imagine. There are many affordable options available for all drivers, despite the fact that Virginia is home to several insurance giants.

Cheaper insurance for drivers who have a good driving record

Geico has the cheapest car coverage in Virginia, for drivers with good driving records. This company provides great customer support and offers affordable policies to both new and experienced motorists. Snapshot is a program that allows you to customize the policy to meet your specific needs. It can also help you save money by rewarding safe drivers.