The average cost of auto insurance per month is a major consideration for all drivers. You want to get the best coverage at an affordable price so that you don't end up paying more than you need to for your insurance policy. This article will discuss how to calculate the average car insurance cost. We will also discuss what factors influence this number and how you can get the best deal.

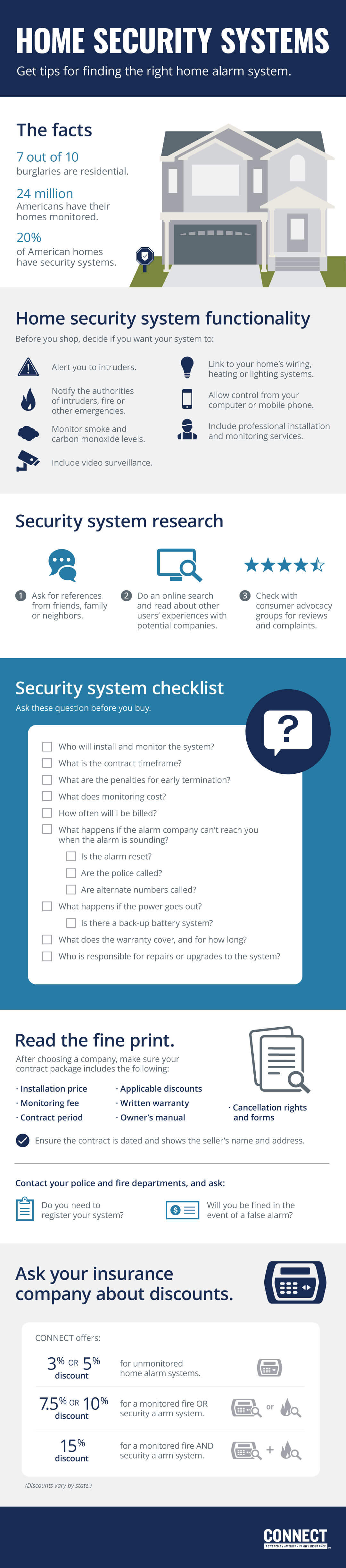

Where You Live. State-by state pricing can differ widely. Some states have minimums that are hundreds more expensive than others. The local risk factors of each state such as climate, population, and crime rates also influence the rate.

Your Car: The type and model of the car you drive can have a major impact on your insurance costs. Insuring sports cars and pickup trucks is more expensive than insuring standard cars due to the higher repair cost, speed limits and statistical likelihood of an accident.

A clean driving history can lower your car insurance costs. Your costs may increase if you've got a bad record. In fact, drivers with a history of traffic violations or accidents can see their rates increase by up to 70% on average.

Credit Scores: Drivers with better credit scores are less likely than those with lower credit scores to file a claim, which could lead to a cheaper rate for car insurance. But in some states, credit data can't be used to determine car insurance premiums.

What You Pay: The amount you pay for car insurance can vary depending on many factors. These include your age, your vehicle's make and model, and your driving record. It's often important to compare quotes from several different companies so that you can get the best coverage at an affordable price.

What are the most expensive vehicles to insure?

If you're in the market for a car, it doesn't matter whether you buy new or used. The vehicle type you choose will affect your average car insurance cost. Due to their low repair costs, safety ratings and low accident rate, SUVs and Minivans have lower insurance premiums.

What you can Do About It: To reduce your insurance rates, the best thing to do is to avoid traffic violations. This will help to keep your premiums low. Take a defensive driving class, attend driver's education classes or add safety features to your vehicle to reduce the chances of a claim.

Ask for a Low-Mileage Discount. This is a great option to save money on auto insurance. These discounts are offered by many insurance companies to drivers who do not drive much or travel long distances.

A Better Credit Score: Having a good credit score is a sign of being responsible and reliable when it comes to making payments on loans and other financial obligations. It can also help you get cheaper auto insurance, especially if in good health with no previous history of high repair or medical bills.