In order to protect and maintain your biggest asset, you need affordable homeowners insurance in NJ. It protects against losses including theft, liability and disasters such as those that could cause your home to be destroyed.

It's important to find the right balance between your budget and coverage. This is why we've partnered with America's leading insurers to provide you with a policy which protects your home, gives you peace and mind at an affordable price.

Find the lowest priced home insurance in NJ

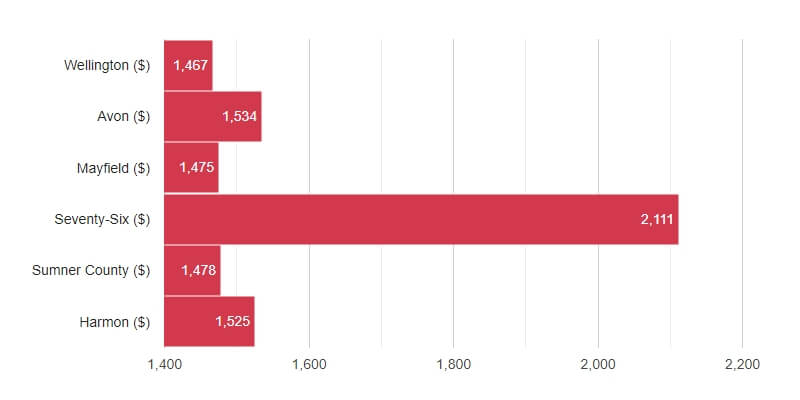

We gathered thousands of quotes as well as analyzed the customer satisfaction rating from top New Jersey-based insurers to help you find the company offering the most affordable insurance. In addition to comparing rates with different coverage options, we also looked at discounts and other factors.

Get the best home insurance coverage in NJ

We found the cheapest home insurance companies in NJ with the best average costs for different types of policies, including those that include fire, theft and flood protection, as well as policies that have low deductibles or no deductible at all. We then ranked those companies based on their Bankrate Scores, which are a combination of third-party ratings and premium data.

USAA, Allstate, and Travelers are our top picks. They all have high Bankrate scores and provide great value for money. These companies have high Bankrate Scores due to their top-notch scores in areas including customer service and financial health, which shows that they pay claims on time.

These companies also offer many discounts that can lower your annual premiums. The discounts range from bundling home and auto insurance policies, to having a good driving record, or even being a first-time home buyer.

Chubb is one the cheapest insurance companies in New Jersey. Their average rate per year is $745 for basic dwelling coverage up to $250,000. This coverage pays for the cost of rebuilding a home in the event of a covered disaster like a hurricane, tropical storm, or flood.

Lemonade, a great option for New Jersey residents is its AI software. Its mobile app and its website make the process of filing a claim quick and simple. It also donates unclaimed premiums to charities, and its $500 minimum deductible can give you a larger payout when you make a claim.

The mobile app allows you to easily manage your policy. You can also choose from a variety of other policies to meet your needs, including flood insurance and medical payments.

The cheapest home insurance companies in nj are NJM, which offers standard policies for $802 per year, or $67 per month. The average home insurance policy in New Jersey costs $802 per year, or $67 per month.