Idaho homeowners need to have homeowners insurance. While it is not required by law, many lenders refuse to loan money on a property that does not have coverage. A home insurance policy can help you protect yourself from theft and natural disasters.

Idaho has a low cost homeowner's policy. The average cost for homeowners insurance is $438 annually, which makes it less expensive than the national standard. There is an enormous range of rates depending upon where you live. It is important to shop around.

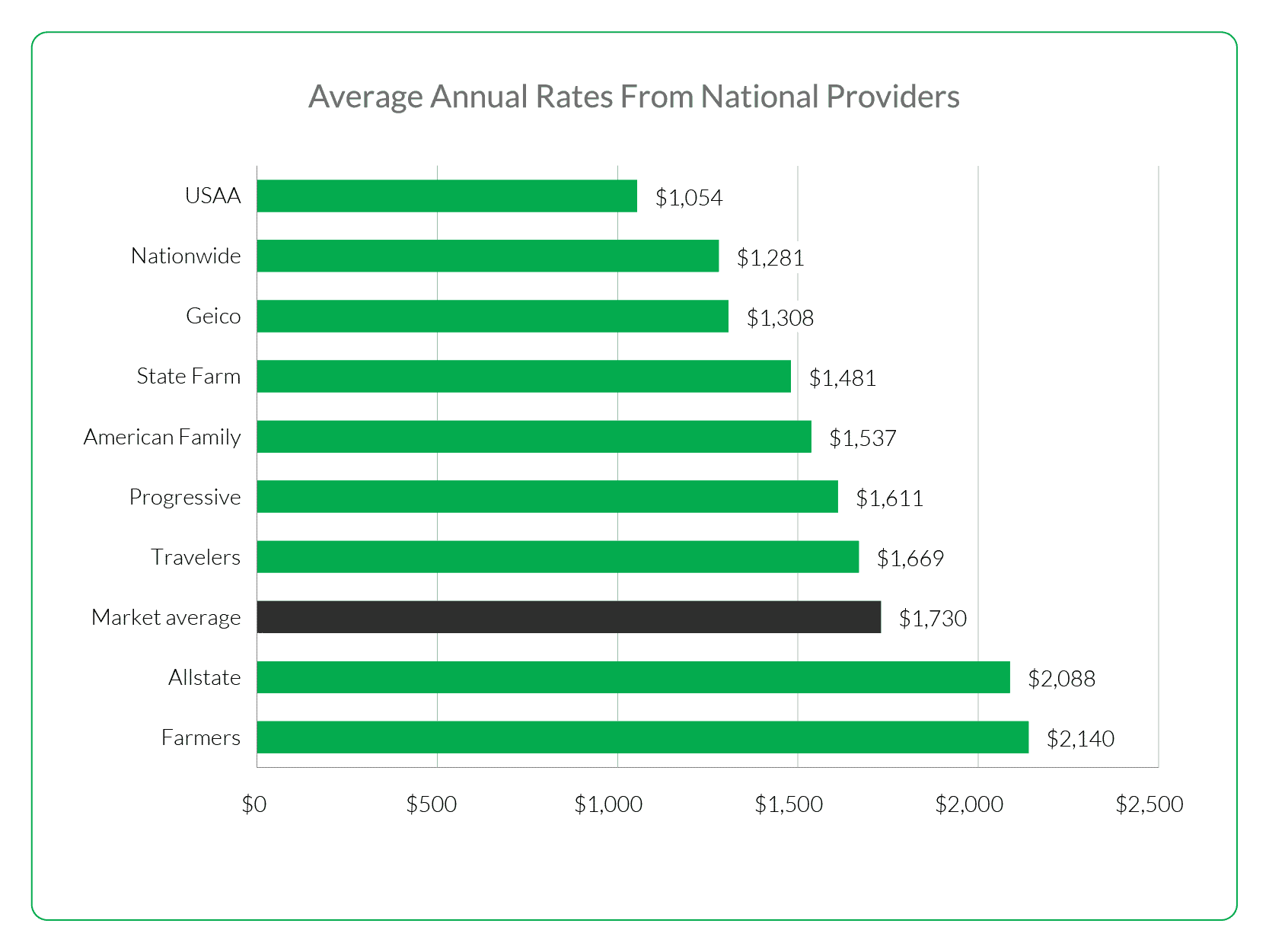

Comparing quotes from different companies is the best way to find a fair premium. There are several resources that will help you do this. MoneyGeek is an excellent service to help you find the best deal. It is also a smart idea to review different companies. A company that is well-respected will pay more for claims, while a company with less reputation may not pay.

Insurers will evaluate a number of factors in order to calculate your premium. They will take into account the value of your home, its features and the frequency with which you have had to file insurance claims. A factor is also your deductible. It is possible to lower your premium by increasing your deductible.

Discounts can be offered by insurance providers. Many insurance companies offer senior and new homeowner discounts. Other companies offer multi-policy discount. Getting a discount is a smart move, especially if you are buying a more expensive home.

Many companies offer endorsements that provide additional protection. These endorsements can cover your lawn and high-end items. You will also need additional coverage if your pool is damaged.

The most basic home insurance policy will cover fire damage. If you are in a flood-prone area, you may also need to purchase flood insurance. You also have the option of purchasing earthquake insurance. Depending on your personal situation, you may also be eligible for additional coverage that will help with rebuilding and repairs.

An important aspect of protecting your home and your family's finances is choosing the right insurance policy. Insurance is an extremely risky decision. Even a small fire can cause thousands of dollars worth of damage. A good coverage policy is the first step to protecting your most valuable financial asset.

It is no easy task to find the best home-insurance company. This is especially true for Idaho, which is prone to flooding and wildfires. Fortunately, you can find a reputable and affordable insurer.

No matter if you are a new homeowner or a veteran, it is important to take the time and find the right homeowners insurer for your needs. FEMA Flood Map Service Center will show you where floods are most likely to occur. JD Power also tracks homeowners insurance in the state.

A tool such as Insurify is a great way to compare Idaho home insurance. It is designed to help you get the most accurate homeowners insurance quotes in the state.