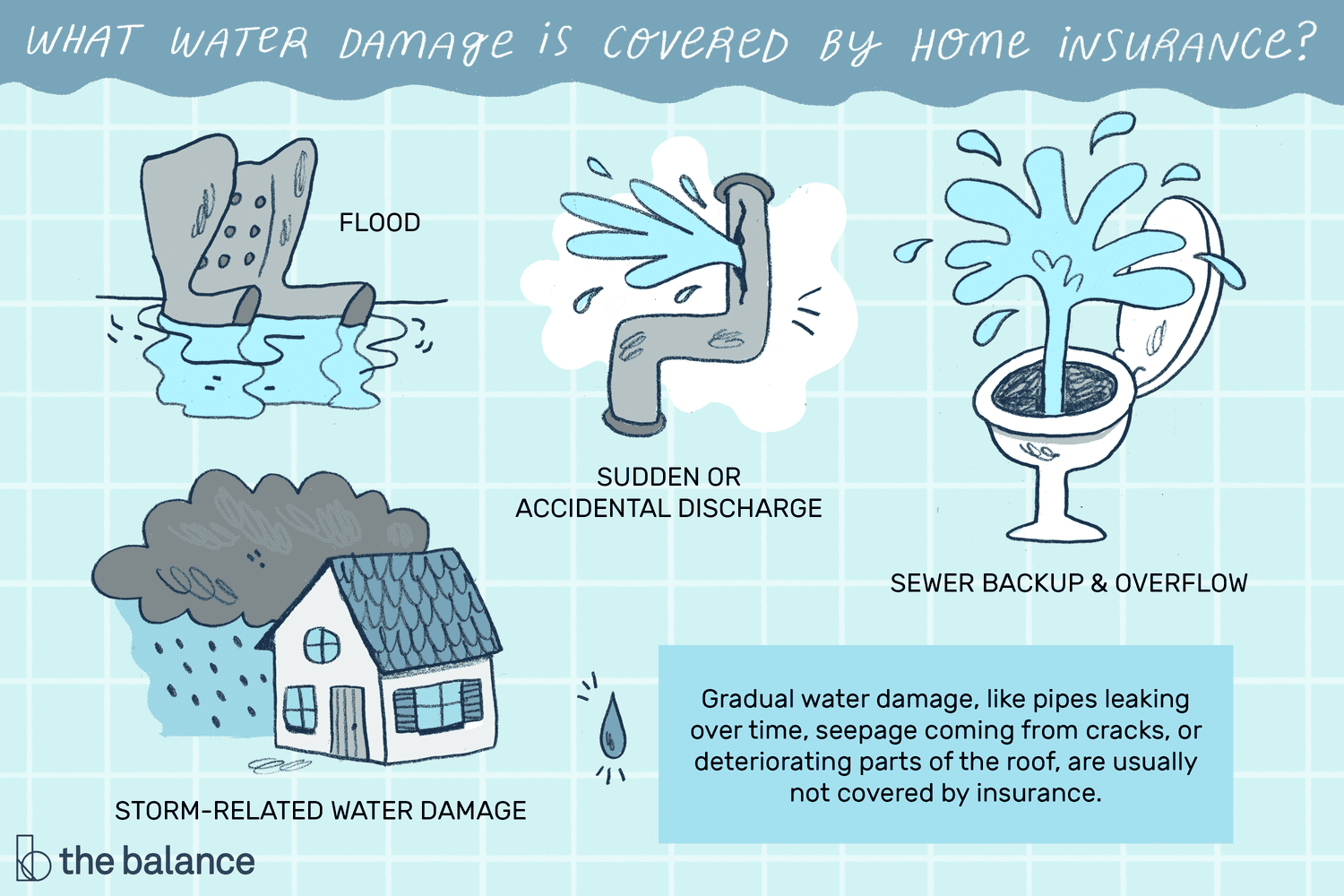

Virginia homeowners coverage protects your house from the dangers of fires, floods, and other natural disasters. The insurance also covers personal items that are lost or damaged. Whether you're a first-time homebuyer, a veteran or an experienced homeowner, getting the right insurance coverage is essential for your peace of mind and financial security.

Best Homeowners Insurance Virginia

Virginia offers quality homeowners insurance for a low price. Compare quotes and take into account several factors. Included are coverage options, discounts, and customer service ratings.

Insurance costs are affected by your location, age and the likelihood of a natural disaster. If you live in a risky area, you may want to consider combining policies or purchasing flood insurance.

Virginia home insurers charge different rates depending on where you live and what type of house construction is in your home. Newer homes generally are less risky than older ones, as they're built with better materials and safety features.

Compare the coverage, deductibles, and endorsements of your policy. While lower deductibles are likely to reduce your premium, higher deductibles as well as coverage add-ons may increase it.

You can save money on your homeowners insurance by having a good credit score. Customers with high credit scores can get discounts from many Virginia insurance companies.

Bundling your insurance policies with others can result in discounts. If you combine your Nationwide homeowners and auto insurance, for example, then you can save 20%.

Virginia Homeowners Insurance: How to Choose the Best Policy

Virginia homeowners insurance can be customized to fit your needs. It is important to compare all the available options, and to choose a plan that will cover your property at fair market value.

You might want to include items like jewelry or collectibles you won't likely replace. You may also want to consider coverages for your items that will protect them from water damage. These include flood and icestorm insurance.

Consider USAA's policy for home insurance if you are a military member. This company provides excellent customer service, and it offers several options to members of the military. This insurance company offers several options for members of the military, including coverages that are tailored to those serving in warzones.

USAA's annual rates are higher than the average, but it is still a great choice for people who serve in military or their families. The personal property coverage of USAA protects you and your belongings while you are in the military. It also waives your deductible for claims involving your uniform when you are on active duty.

Truck Insurance Exchange provides affordable homeowners insurance policies for newly-built homes. Its average premium per year is less than the average state rate for these properties. In addition, it provides strong general coverage including full replacement value, landlord protection and earthquake insurance.