Each driver must consider how much their average monthly car insurance costs. It's important to find the right coverage for an affordable price to avoid paying more than necessary for your insurance. We'll look at the average price of car insurance in this article and explain how it is calculated. We'll also cover what factors affect this number and explain how to make sure you're getting the best deal.

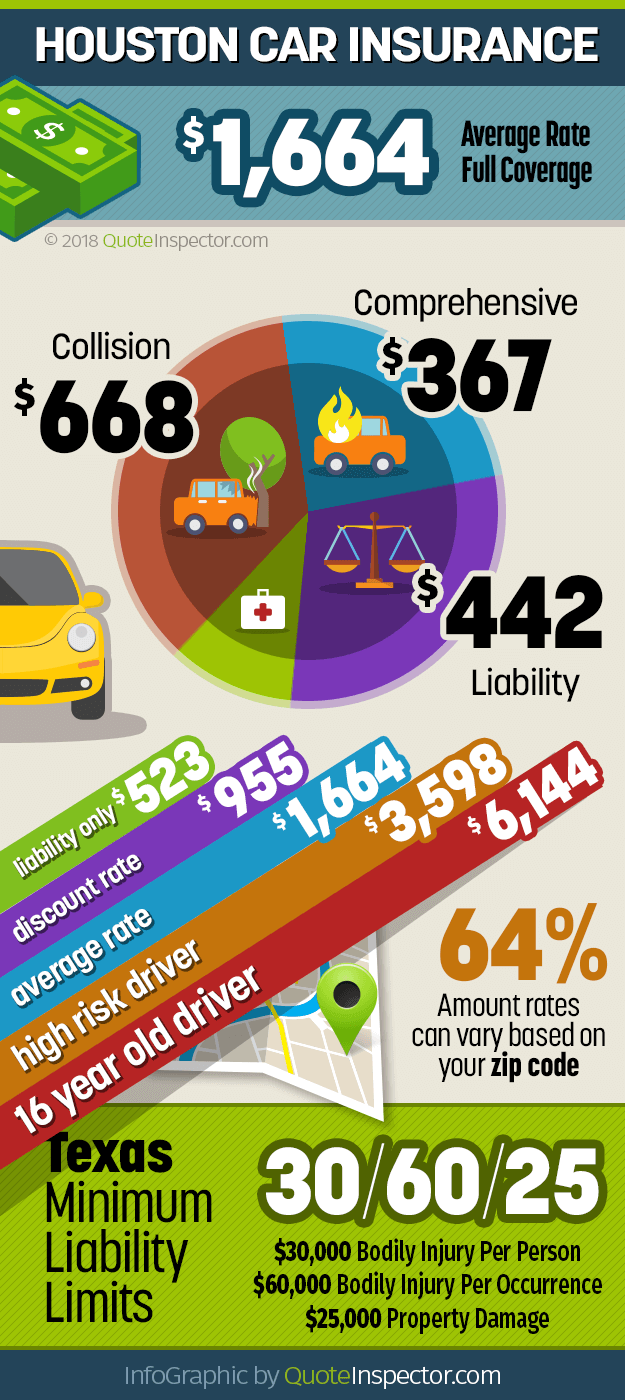

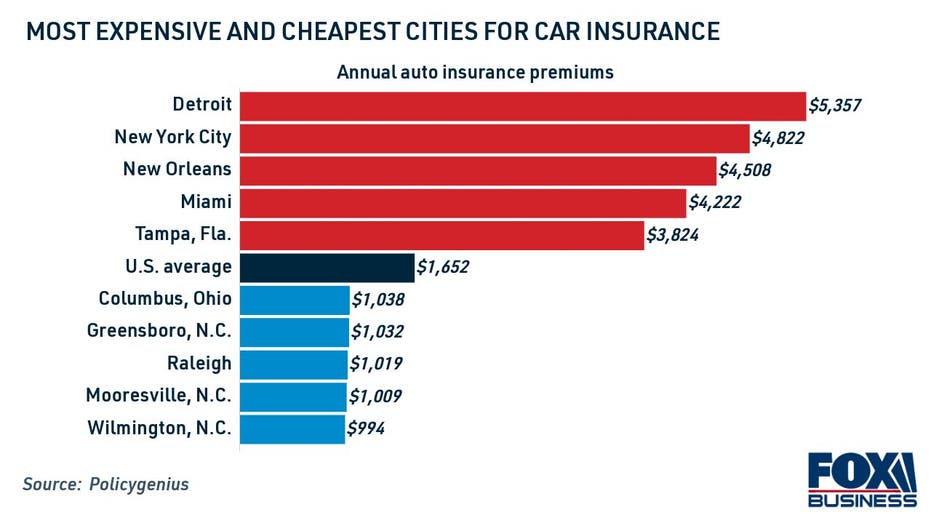

Where You Live. State-by state pricing can differ widely. Some states have minimums that are hundreds more expensive than others. The local risk factors of each state such as climate, population, and crime rates also influence the rate.

Your Vehicle. The type of car that you drive is a factor in your car insurance rates. Insuring sports cars and pickup trucks is more expensive than insuring standard cars due to the higher repair cost, speed limits and statistical likelihood of an accident.

Driving History: Having a clean driving record can help you secure lower car insurance rates. However, if you have a bad driving record, your costs can skyrocket. Drivers with a record of traffic violations and accidents may see their rates rise by as much as 70%.

Credit Score: Drivers who have good credit tend to be less likely to make claims than drivers with bad credit. This can result in lower car insurance rates. Some states do not allow credit scores to be used when determining car insurance premiums.

How Much You'll Pay: Your insurance payment is influenced by several factors such as age, make and type of vehicle, and driving records. Comparing quotes from different companies is important so you get the best price and coverage.

Insurance for the Most Expensive Vehicles:

The type of vehicle that you drive can have a big impact on the average cost of your car insurance, whether you are looking to buy a new car or a used one. In general, SUVs, minivans, and other vehicles with lower safety ratings, less frequent repairs, and lower accident rates have cheaper insurance premiums.

What You Can Do About It: The most effective way to reduce your car insurance cost is to avoid a traffic violation and prevent an accident in the first place. You can enroll in a defensive driver course, take driver education classes, or install safety equipment on your car to lower the odds of a claim.

Ask your insurance provider about a low-mileage rate. It's a good way to reduce the cost of your auto insurance. Many insurance companies offer discounts to drivers that don't travel a lot, or who don't take their cars on long trips.

A better credit score: A good credit rating is a sign that you are responsible and reliable in your payments for loans and other financial obligations. A good credit score can also result in lower insurance rates for your car, particularly if you are healthy and have no history of large medical bills or expensive repair costs.